Mortgage Giants in Critical Care

Jul 31, 202044.9K Shares1M Views

Image has not been found. URL: file:///Users/intern1/Library/Caches/TemporaryItems/moz-screenshot.jpgImage has not been found. URL: /wp-content/uploads/2008/09/fan-mac.jpg

Both Fannie Maeand Freddie Mac, which have been almost single-handedly keeping the U.S. home mortgage markets afloat, announced their first half-year results last week. If they were cancer patients, the doctors would transferring Freddie into hospice care. Fannie is probably terminal as well, but is in better shape and might have a fighting chance.

Fannie and Freddie are “government-sponsored entities,” or GSEs. (There is a third GSE, the Federal Home Loan Banksystem, that has been almost the sole support of Countrywide Bank over the past several years.) Fannie and Freddie don’t originate mortgages directly, but create liquidity by either guaranteeing mortgages for other lenders or buying them up for their own balance sheets.

Illustration by: Matt Mahurin

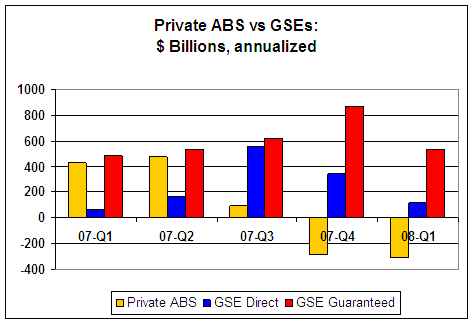

The chart below shows the lending and guarantee activity for the GSEs for the five quarters through March, 2008. For comparison, it also shows the volume of ABS, or “asset-backed securities,” that are a good proxy for private, unguaranteed mortgage activity. By 2007, almost all such mortgages were packaged up and sold to investors as ABS, while most ABS were backed by mortgages.

The chart shows how the GSEs leaped into the breach when the private mortgage markets collapsed in mid-2007. By the third and fourth quarters, they were virtually the sole support of the markets, but were digging deeper and deeper financial holes. The first-quarter 2008 tightening shown in the chart continued in second quarter. Both Fannie and Freddie say it will do so for the foreseeable future.

Source: Federal Reserve Flow of Funds Report (June, 2008)

Why are they in such trouble? Fannie and Freddie were created to lubricate the home mortgage market by buying mortgages from lenders; wrapping them with a guarantee, and packaging them up as tradeable securities sold to long-term investors — like pension funds and foreign central banks.

The guarantee works because there are strict rules about the credit quality of the mortgages they buy. “Conforming,” or guarantee-eligible, mortgages must be well-documented, conservatively structured and held by borrowers with good credit. Default rates are low, so guarantee fees are modest.

Together, Fannie and Freddie guarantee $4.1 trillion in mortgages. The business is profitable, but not egregiously so, and almost everyone agrees that it works fine.

What got them into trouble is their otherbusiness, that wags call their “$1.6 trillion hedge fund.” Because global investors assume that Fannie and Freddie debt is “implicitly” guaranteed by the government, they can borrow at below-market rates. After all, their executives reasoned, if Goldman Sachs can make so much money trading for their own account, why shouldn’t they? They had stockholders, they sincerely lusted after Goldman-scale paychecks and the implicit government guarantee would let them tap almost unlimited capital.

So, between the two of them, they have now borrowed $1.6 trillion to build positions in mostly mortgage-backed assets, including good dollops of risky subprime and Alt-A mortgages, and “structured” mortgage-backed securities. So, of course, the housing market collapse that is destroying careers and balance sheets all over Wall Street is wreaking havoc at Fannie and Freddie.

Freddie is already a walking corpse. It ended the half with its balance sheet leveraged up 68:1, or more than twice as high as Bear Stearns just before its collapse. And that’s only if you assume their books are truthful. Though that’s unlikely.

One item deep in their financial footnotes is especially ominous. Accounting valuation rules usually classify mortgages and mortgage-backed securities as “Level 2″ assets. While they don’t have daily market prices, like IBM stock, they can be usually valued by a combination of “observable” market values and internal judgments.

When the market for complex securities backed by high-risk mortgages collapsed last year, many banks shifted their holdings down to “Level 3,” which allows you value solely by “internal models.” In real life, that means almost any way you please. Accounting standards bodies led a concerted drive to move such assets out of Level 3 back up to Level 2, for greater transparency.

Freddie has gone the other way. During the first half of the year, they moved $154 billion of securities backed by high-risk mortgages from Level 2 to Level 3. A reasonable guess is that they’re carrying them at 80 cents on the dollar, or thereabouts.

But these are the same class of instrument that Merrill Lynch recently cleared off its books for 22 cents on the dollar. At a minimum, Freddie may be sitting on another $30-$50 billion in losses. Freddie ended the half with only $13 billion in equity supporting $879 billion in assets. If a beam of sunlight hits those Level 3 assets, the walking corpse instantly shrivels into ashes.

Almost laughably, Freddie plans to solve its problems by raising another $5.5 billion in capital -– or will as soon as its investment bankers tell them the time is “propitious.”

Don’t hold your breath. Freddie’s total stock market value is now only about $3.8 billion. What percent of a $3.8 billion company do you sell to raise another $5.5 billion? And, oh, by the way, their chief executive, Richard Syron, was paid $20 million last year.

Fannie has been pulling in its horns faster than Freddie and raised substantial capital in the first half of the year. Their overall leverage is now only about 22:1 — or about a third of Freddie’s. But their future is still bleak. Like Freddie, their stated equity includes huge deferred tax assets, which they may never realize. Normal bank accounting rules would assign much lower values.

Fannie has absorbed $6 billion in net losses so far this year, and expect losses in that range to continue for the rest of the year. The losses should continue well into 2009, but they hope at a lower level. A normal company could not survive.

Is a rescue on the way? Congress recently authorized the Federal Reserve and the Treasury to lend as much as they want to bail out Fannie and Freddie. That is the topic for Part II of this article.**

Charles R. Morris, a lawyer and former banker, is the author of “The Trillion Dollar Meltdown: Easy Money, High Rollers and the Great Credit Crash.” His other books include “The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould and J.P. Morgan Invented the American Supereconomy” and “Money, Greed, and Risk: Why Financial Crises and Crashes Happen.”

Paula M. Graham

Reviewer

Latest Articles

Popular Articles