Impact Of Halving On Mining - Bitcoin Halving 2024

Discover the seismic shift in cryptocurrency, impact of halving on mining! Unveil how this phenomenon reshapes the industry landscape and affects your investment strategy.

Author:James PierceReviewer:Camilo WoodMar 06, 20241K Shares47.1K Views

Bitcoin, the forerunner and poster child of the digital currency revolution, continues to lead the way as the world of cryptocurrencies develops. Bitcoin's distinctive monetary policy, which includes recurring "halvings" events, and theimpact of halving on miningcomes as their continued success.

The Bitcoin halving is in this year 2024, so miners and the larger cryptocurrency community are preparing for this momentous occasion. We'll go over Bitcoin halving tactics, how miners are getting ready for the impending halving of Bitcoin in 2024, and all the important details in this in-depth blog post.

How Are Bitcoin Miners Preparing For Bitcoin Halving 2024?

For the upcoming Bitcoin halving, miners are getting ready, which is scheduled for April 2024, when the number of blocks reaches 840,000. The reward per block will decrease from 6.25 to 3.125 BTC at that time.

These miners are using a variety of tactics to make sure their operations stay lucrative despite receiving less block rewards because they have learned from previous halving occasions. They are taking the following important actions:

1. Enhanced Efficiency And Scaling

- In order to stay efficient and competitive, miners are improving their hardware. Purchasing the newestApplication-Specific Integrated Circuits (ASICs), which can solve cryptographic challenges more quickly and with less power usage, is frequently required to do this.

- By picking ideal locations with cheap electricity rates and availability to renewable energy sources, they are maximizing the efficiency of their mining operations. In order to pool their computing power and improve their chances of winning rewards, miners are also joining mining pools.

2. Energy Efficiency And Sustainability

- A lot of Bitcoin miners are switching to more environmentally friendly energy sources as the importance of environmental sustainability grows. By doing this, they lessen their carbon impact and contribute to achieving international sustainability targets.

- In order to reduce their energy expenses, several miners are looking at alternative energy sources like solar or wind power. By doing this, they lower operating costs in addition to making a positive environmental impact.

3. Spread Out Their Sources Of Income

- Miners are aware that depending only on block rewards could not be a long-term tactic. They are investigating diversifying their sources of income in order to lessen this.

- This can involve staking, providing additional services inside the blockchain ecosystem, or engaging in decentralized finance (DeFi) platforms. Miners can offset the lower block rewards by looking for alternative sources of income, which will guarantee the stability and profitability of their businesses.

4. Strategic Risk Management

- To deal with the volatility of the cryptocurrency markets, miners are using risk management strategies. This covers trading options, hedging techniques, and keeping cash on hand to pay for day-to-day expenses in the event of difficult market circumstances.

- Miners are also precisely timing their Bitcoin sales to take advantage of market changes and minimize needless risk.

5. Cooperation & Joint Ventures

- The mining industry is becoming more collaborative. To take advantage of economies of scale and boost their competitiveness, miners are collaborating and pooling their resources.

- To guarantee access to cutting-edge technology and financing choices, strategic alliances with hardware makers, energy providers, and financial institutions are becoming more and more popular.

What Is Bitcoin Halving?

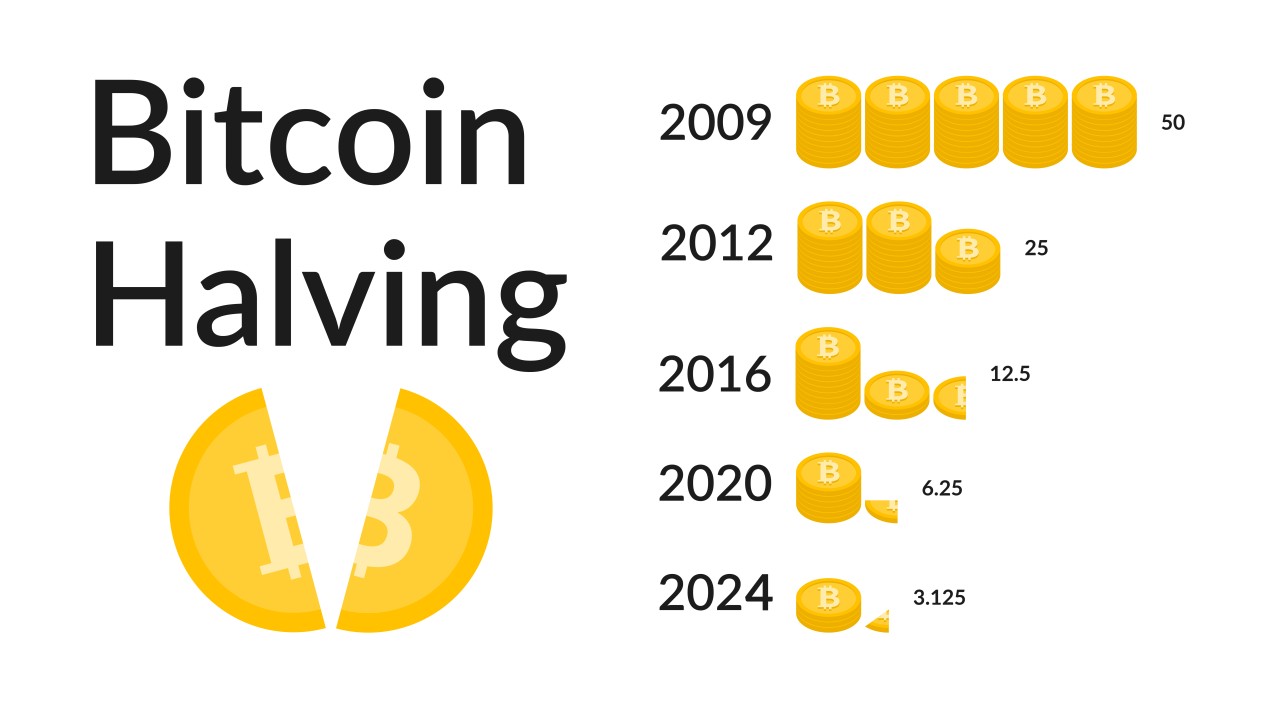

Each 4 years, or after 210,000 blocks have been mined by the network, Bitcoin miners receive a block reward that is halved. Because it reduces the amount of fresh bitcoins issued into circulation by half, this event is known as the "halving."

The intended 21 million coin cap will be achieved at some point in 2140, at which point this rewards program would end. At that point, network users will pay miners' fees in exchange for their processing of transactions. These costs guarantee that miners will continue to be motivated to contribute and maintain the network.

The reason the halving event matters is because it represents a further decline in the rate at which Bitcoin is created as its supply gets closer to being exhausted. 50 bitcoins were awarded for mining each block in the chain in 2009. Only roughly 1.5 million bitcoins remained to be released through mining awards as of October 2023, out of the approximately 19.5 million in circulation.

How Does Bitcoin Halving Affect Mining Rewards?

The halving of Bitcoin is a predetermined occurrence that takes place about every four years; the next one is scheduled for 2024(this year). Half of the mining rewards are distributed during halving, which lowers the amount of fresh Bitcoins in circulation. Here is how mining is impacted by this process:

- Reduced Income- As a result of a 50% drop in incentives for confirming transactions and adding them to the blockchain, miners may find it more difficult to make a profit, particularly if their operating expenses are higher.

- Enhanced Competition- As a result of lower returns, miners are forced to work harder, buy better gear, and look for more affordable sites. Enhanced efficiency and scalability are crucial in this competitive landscape.

- Effect on Supply- The halving of Bitcoin adds to the cryptocurrency's scarcity. The price of Bitcoin tends to increase with scarcity, offsetting the lower block incentives for miners. This increase in value helps somewhat offset the decline in income.

- Historical Price Surge- In the past, significant price rises have occurred during Bitcoin halving events. Prices for Bitcoin have frequently increased as a result of lower supply and lower revenue for miners. New investors and miners are drawn to the ecosystem by this phenomena.

- Mitigation tactics- In order to lessen the effects of halving, miners employ tactics include increasing productivity, adopting sustainable energy sources, diversifying their revenue streams, and controlling market volatility.

How Halving Influences Bitcoin’s Supply And Demand?

The halving of Bitcoin has a direct influence on supply since it slows down the creation of new coins, resulting in a scarcity effect. If investor interest in and acceptance of Bitcoin continue to rise, this scarcity may result in higher demand.

Since a result, there is a strong correlation between the price of Bitcoin and its halving, since historical occurrences have frequently preceded price increases. This is consistent with the well-known economic theory of supply and demand dynamics, and it makes Bitcoin one of the top cryptocurrencies to purchase in 2024.

Halving’s Impact On Bitcoin Price

The effect on the price of the cryptocurrency is one of the most expected results of Bitcoin halving. This almost four-year-old occurrence has traditionally had a significant impact on the price of Bitcoin.

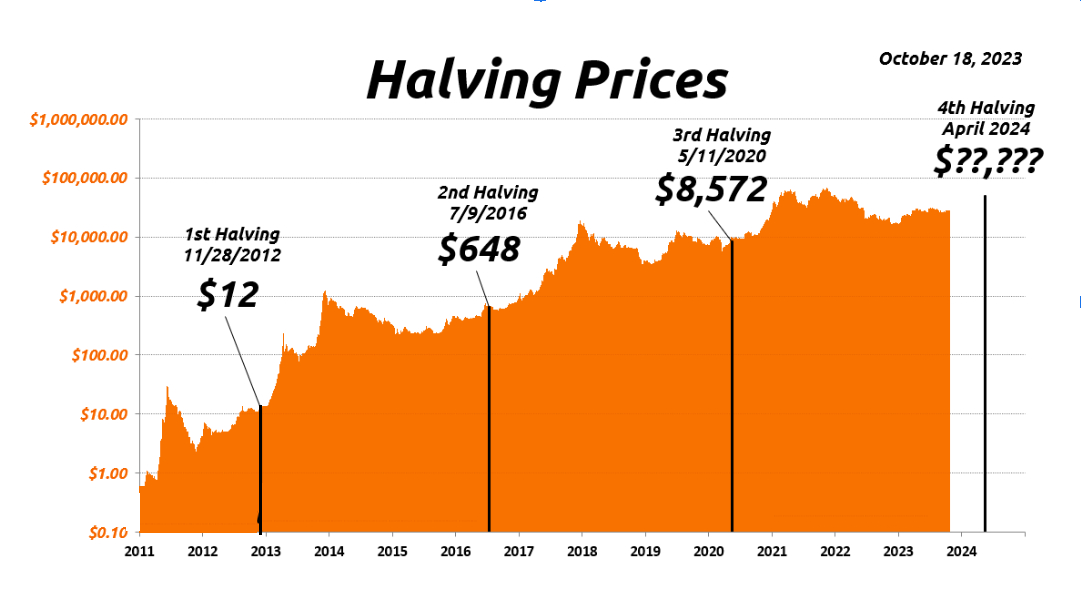

Historical Context

- In the year that followed the 2012 Bitcoin halving, the price of BTC surged by an incredible roughly 10,000%.

- Following the subsequent halving in 2016, the price of Bitcoin increased by over 2,800% in just 18 months.

- Ultimately, following the third Bitcoin halving in 2020, the price of BTC increased by nearly 650% in the ensuing twelve to eighteen months!

Many people believe that following the next Bitcoin halving, there will be a big price surge due to these historical performances. Though precise forecasts differ, some have even proposed possible price increases of $100,000 to $1 million per Bitcoin.

The Idea Behind The Bitcoin Halving

The purpose of the halving, according to Satoshi Nakamoto, was to provide miners with disproportionate incentives in the early going. Encouraging individuals to begin mining and contribute to the network's establishment was the primary goal.

Bitcoin featured incentives of 50 BTC for each and every block at first. Large prizes were crucial in helping the network get started, but it was also crucial to cut awards methodically in order to keep the overall supply under 21 million.

The halving method was first implemented at this point. The reward for miners who complete 210,000 blocks, roughly four years, have their block payment cut in half. Subsequent to the initial halving, the reward was lowered to 25 BTC. Subsequent halvings brought the reward down to 12.5 BTC, 6.25 BTC, and 3.125 BTC.

FAQ's About Impact Of Halving On Mining

How Is Mining Affected By The Halving?

The quantity of newly generated coins is reduced by 50% as a result of the halving, and the rewards for miners are reduced by half. A portion of the revenue decline may be offset by growing Bitcoin prices as a result of fewer coins being produced.

How Has The Halving Of Bitcoin Affected People?

Some predict that the halving would result in a sharp rise in Bitcoin's price because of the increased demand and associated value that come with a lower inflation rate.

Does The Halving Of Bitcoin Hurt Mining?

The perception of whether the Bitcoin halving is beneficial or detrimental varies. As a result of the short-term reduction in their earnings for mining new blocks, miners may see it negatively. It may become unprofitable for some miners to continue mining if the price of Bitcoin doesn't increase to offset the lower rewards.

Conclusion

Bitcoin halving events are important turning points in the cryptocurrency realm, because impact of halving on mining affect many facets of the ecosystem. The crypto community is preparing with plans to handle this momentous occasion. Although miners are concentrating on boosting productivity, enhancing sustainability, and broadening their sources of revenue, the decline in mining incentives could provide difficulties.

Due to a decrease in supply and a rise in demand, Bitcoin prices have historically climbed after halving events. These patterns which were demonstrated by the halvings in 2012 and 2016 offer a historical framework for comprehending potential outcomes in 2024.

Jump to

James Pierce

Author

Camilo Wood

Reviewer

Latest Articles

Popular Articles