Can an Accounting Fix End the Financial Crisis?

Some experts and politicians believe that the mark-to-market accounting rule is to blame for the financial crisis--and they want to modify it; opponents say that would cloud companies’ true financial health.

Jul 31, 202081.8K Shares1.1M Views

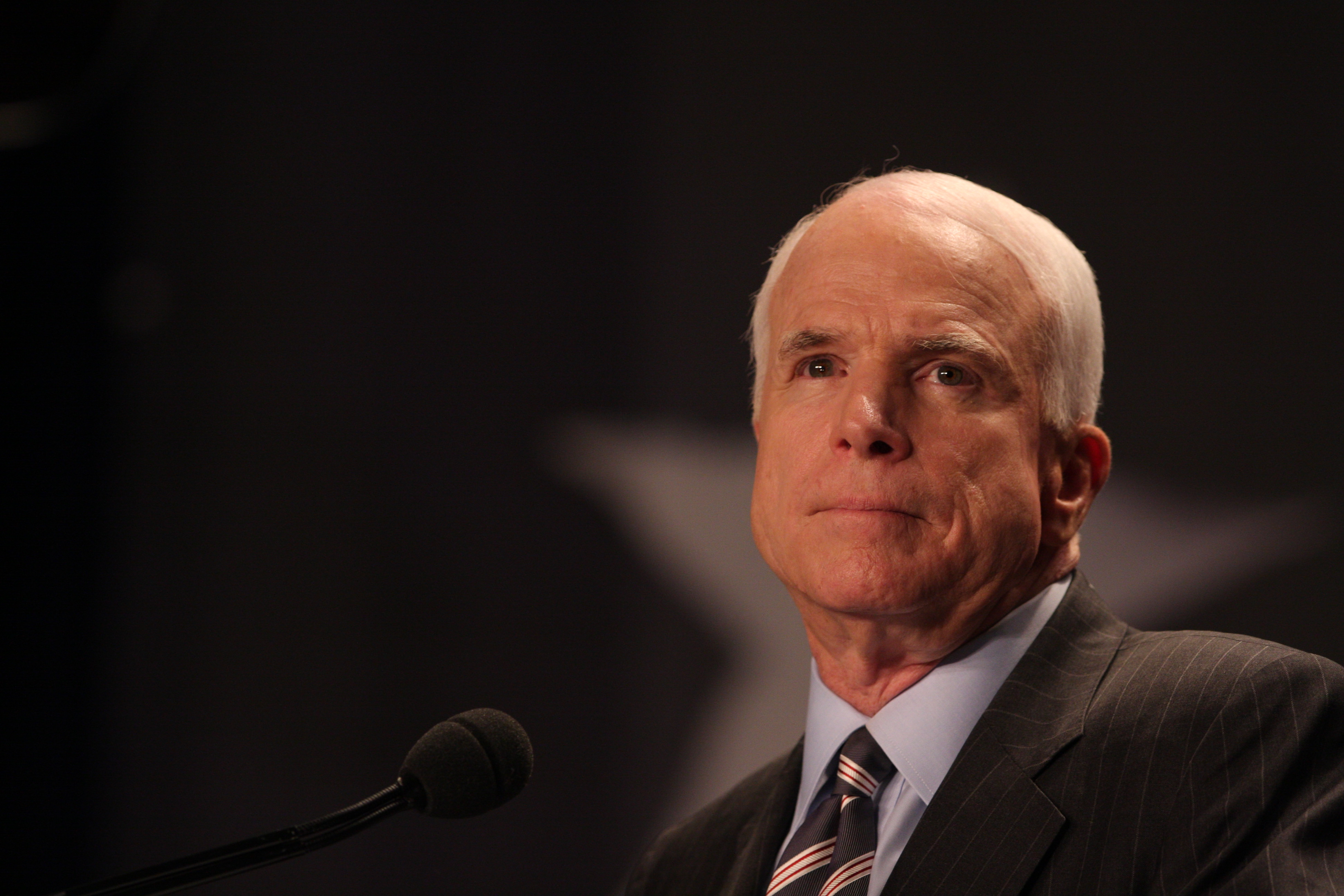

Sen. John McCain (WDCpix)

PHOENIX—Lost amid the Senate’s Wednesday night passage of a $700-billion Wall Street bailout plan was an effort by Sen. John McCain and others to “fix” an accounting rule that they believe has helped create the crisis.

The Securities and Exchange Commission and the Financial Accounting Standards Board, or FASB, on Tuesday issued “clarifications” regarding the rule, known as mark-to-market. The new directive allows companies to value their assets according to their estimated future cash flow, rather than current market prices.

Illustration by: Matt Mahurin

There are few buyers for many of the assets on the books of financial institutions, especially mortgage-backed securities. That makes them difficult to value. The price uncertainty has driven their market value down as much as 80 percent, threatening the solvency of many banks.

Banks and securities firms have already written down $500 billion worth of mortgage-backed paper as home prices have fallen and foreclosures skyrocketed.

The Senate bill calls for the SEC to issue a report to Congress on the effect of mark-to-market accounting on the financial industry within 90 days of the legislation becoming law. It also gives the SEC authority to suspend the mark-to-market rule.

The bill now moves to the House, where a vote is expected Friday. Members of the House Republican Study Committee are saying they want the mark-to-market rule scrapped.

McCain first called for repeal of the accounting rule in March. His presidential campaign issued a statement Tuesday supporting the SEC decision to relax the rule.

“John McCain is pleased to see that the SEC had finally decided to permit alternative accounting methods to mark-to-market accounting for securities where no active market exists,” McCain’s senior policy advisor Doug Holtz-Eakin said.

The American Bankers Assn. also praised the SEC’s action, saying “This guidance will help auditors more accurately price assets that are difficult to value under current market conditions.”

Critics, however, contend that allowing companies to base the value of their assets on unknown future cash flows will only cloud their true financial condition.

William Black, former deputy director of the Federal Home Loan Bank Board, said Tuesday that the SEC’s decision to relax the rule is an attempt to “cover up” the extent of the financial problems facing lenders. Black blames a similar accounting change for worsening the savings and loan blowup in the 1980s.

The SEC, McCain and others “want to use the same phony accounting to try and cover up losses, which will only make the losses much greater in the future,” said Black, now an assistant professor of law and economics at the University of Missouri at Kansas City.

But many economists, business leaders and politicians are urging modification or suspension of mark-to-market accounting for lenders holding huge amounts of mortgage-related securities that have no market.

“Assets should not be marked to unrealistic fire-sale prices,” wrote William Isaac, former Federal Deposit Insurance Corp. chairman, in a Sept. 19 Wall Street Journal op-ed article.

Bob McTeer, former president of the Federal Reserve Bank of Dallas and now at the National Center for Policy Analysis in Texas, said on NYTimes.com on Wednesday that suspending the mark-to-market rule “would make a big difference” in easing the financial turmoil. “Mark-to-market was never intended for use in a declining market,” he said.

And in a commentary appearing Monday on Forbes.com, former House Speaker Newt Gingrich urged Congress to suspend the mark-to-market standard to “relieve stress on banks and corporations.”

Accounting groups, consumer advocates and bank analysts, however, oppose scuttling the mark-to-market rule.

The Center for Audit Quality, a nonprofit group funded by accounting firms, sent a letter Tuesday to Congress urging lawmakers not to abandon the rule, arguing that proposals to revoke it “are not in the best interest of investors or the capital markets.”

“The principles of mark-to-market accounting are rooted in the fundamental virtue of transparency and are central to informed market decisions and efficient allocation of capital,” Cynthia M. Fornelli, the group’s executive director, stated in the letter.

Representatives of the nation’s big four accounting firms also object to the rule change. “It’s just bad for investors,” Beth Brooke, global vice chair at Ernst & Young LLP, in Washington, told The Wall Street Journal Wednesday. “Suspending mark-to-market accounting, in essence, suspends reality.”

And Barbara Roper, director of investor protection for the Consumer Federation of America, told The Journal that, “Allowing companies to lie to investors and lie to themselves is not the solution to the problem–it is the problem.”

Black, the former bank regulator, said there is substantial evidence that many lenders have already abandoned mark-to-market accounting by overstating the value of their mortgage-related assets. He said the recent takeovers of Washington Mutual by JP Morgan Chase and Wachovia by Citigroup revealed that losses at the two acquired banks were far greater than anticipated.

“These were enormous losses in the subprime mortgage market that they pretended didn’t exist,” Black said. “That’s called fraud.”

Rather than suspend mark-to-market accounting, Black said federal regulators should conduct more thorough bank examinations of all lenders heavily invested in the mortgage-backed securities. “Look for the ones that have heavy subprime exposure and take supervisory control of the institutions,” Black urged.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles