Big Banks and Payday Lenders

National People’s Action and the Public Accountability Initiative are up with a report on financial links between payday lenders, Main Street banks and Wall

Jul 31, 2020124.1K Shares2M Views

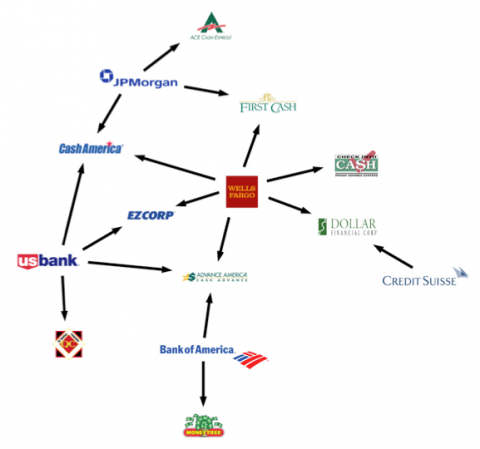

National People’s Action and the Public Accountability Initiative are up with a reporton financial links between payday lenders, Main Street banks and Wall Street banks. “While small businesses and individuals have struggled to get affordable loans in the wake of the taxpayer bailouts, payday lenders have received new and amended credit agreements from Wall Street,” it says. “Instead of wading further into the business of predatory payday lending, big banks need to stop financing these lenders and instead lend to businesses and individuals that create wealth, rather than destroy it.”

The report shows that big banks are providing billions of dollars in loans to fringe financial outfits; in turn, those fringe financial outfits are offering billions of dollars in loans to customers, often at usurious rates. Some payday lenders, for instance, offer short-term, roll-over cash advances with APRs of over 480 percent. The report argues the voluminous Wall Street financing means the payday business will keep expandingthrough the recession, as cash-strapped customers seek unconventional and sometimes dangerous banking products.

But, of course, we’ve known for decades that payday lending and other fringe financial services are big, big business, and the ties between that storefront cash checker and Wall Street are closer than you might think. (For the most in-depth examination of this phenomenon, see Gary Rivlin’s great Broke USA.) Many Main Street banks are actually competingwith payday lenders now, offering their own versions of the same products.

What this really militates for is strong regulationsset for the benefit of consumers, not created under the influence of lobbyists. To that end, the new Consumer Financial Protection Bureau — which maybe, just maybe, will get its leader in soon— should do a lot to constrain the industry’s worst practices.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles