The Case for a New Top Income Tax Bracket

Peter Orszag’s New York Times opinion piece has set off a flurry of discussion about whether to extend tax breaks for the wealthiest Americans and how the

Jul 31, 202017.8K Shares250.7K Views

Peter Orszag’s New York Times opinion piecehas set off a flurry of discussion about whether to extend tax breaks for the wealthiest Americans and how the political fight over the Bush tax cuts might play out this fall. Policymakers’ ultimate goal is to keep the recovery going while ensuring tax revenue helps ease the deficit. A number of options are on the table, but one choice that might be popular and effective has been left out — creating a new tax bracket for very high-income earners.

Democrats could, for instance, offer to create a new tax bracket for the top one percent of earners (those making more than about $410,000) or for any earners making more than $1 million. That tax bracket could pay the top marginal rate before the tax cuts, 39.6 percent, or some rate between the current 35 percent and 39.6 percent in 2011 and 2012. Then, two years from now, Democrats could end the Bush-era tax cuts for all families making more than $250,000 and individuals making more than $200,000, bringing that bracket up to 39.6 percent and pushing taxes on the highest earners up again.

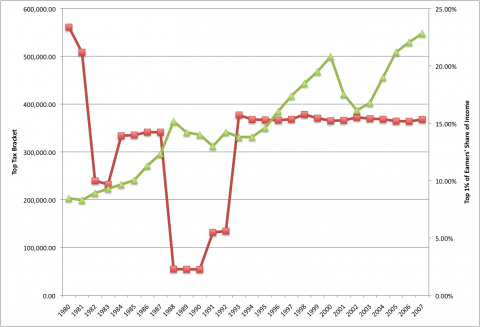

Why would this be a good idea? Politically, it seems workable, since Americans by and large want to soak the richto help pay down the debt. For the past 20 years, the top income tax bracket has started around $370,000, adjusted for inflation, and top marginal tax rate has stayed between 35 and 39.6 percent. But since the mid-1990s, the richest have gotten richer, earning a higher and higher share of all income while paying the same income tax rate as more moderate-income workers.

The Tax Foundation notes: “[B]etween 2000 and 2007, pre-tax income for the top 1 percent of tax returns grew by 50 percent, while pre-tax income for the bottom 50 percent increased by 29 percent.” And the total proportion of taxes paid by very wealthy Americans has declined, as they earn more and more from investment vehicles on which they pay capital gains, rather than income, taxes. The income tax is, of course, progressive. But it could be more so.

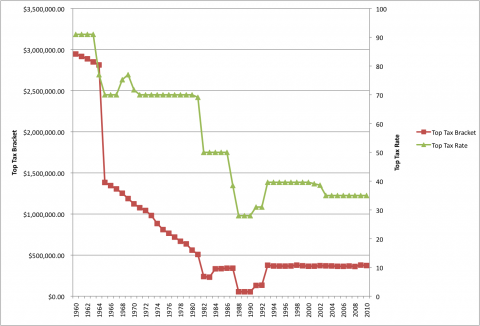

Moreover, America has had tax brackets hitting very high-income workers before. In the 1970s, for instance, the top tax bracket included workers making more than $500,000 a year, and the top rate was higher. (All dollar amounts in this graph are given in 2010 dollars, so there is no skew due to inflation.)

Indeed, until 1973, the top bracket hit workers making an inflation-adjusted $1 million per year.

Rhyley Carney

Reviewer

Latest Articles

Popular Articles