Senate Passes Landmark Financial Reform Bill

The bill, which overhauls the regulation of everything from the biggest banks to the derivatives used by farmers, passed 60-39. President Obama is expected to sign it into law next week.

Jul 31, 20205.1K Shares850.8K Views

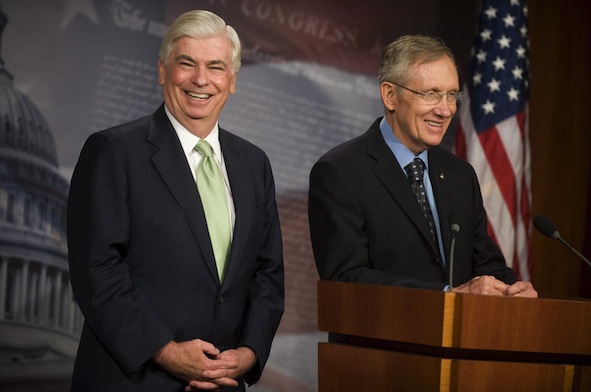

Senate Majority Leader Harry Reid and Banking Committee Chairman Chris Dodd were all smiles after the Senate passed its financial reform bill on Thursday. (epa/ZUMApress.com)

This afternoon, the U.S. Senate passed a sweeping financial regulatory reform bill, overhauling the regulation of everything from the biggest banks to consumer financial products to exotic instruments like credit-default swaps to the derivatives used by farmers. The bill passed 60 to 39.

[Congress1] Earlier on Thursday, Republicans Olympia Snowe (Maine), Susan Collins (Maine) and Scott Brown (Mass.) voted for cloture to end debate and move on to the final majority-rules vote. The billjust madethe cloture mark, with 60 votes. Sen. Russ Feingold (D-Wis.) chose not to vote with his party, saying he did not find the bill strong enough. White House spokesman Robert Gibbs that President Obama will probably sign the legislation into law next week.

Thus ends a yearlong saga for the bill, whose architects Rep. Barney Frank (D-Mass.) and Sen. Chris Dodd (D-Conn.) spent hundreds of hours in negotiations before coming up with the final package. Work on writing the bills started last summer in the House and the Senate. The House approvedits version of reform in December, and the Senate passedits version in May.

The biggest sticking point for reform in the Senate — and one of the reasons the bill took longer than in the House — concerned derivatives, which allow an investor to hedge against price fluctuations in a stock, commodity or other product. The derivatives portion of the bill fell under the purview of the Senate Agriculture Committee, headed by Sen. Blanche Lincoln (D-Ark.). Facing a tough primary challenge from the left, Lincoln inserted a strong provision forcing banks to spin off their trading desks for swaps — a kind of derivative — and to capitalize them separately. Companies vehemently fought against the proposal, but it ultimately appeared, albeit in a slightly changed form, in the final bill.

Once the House and Senate had their bills, the two moved to a conference committee to iron out their differences. In conference committee, the Senate bill was used as the base text, while Dodd led a team of more than 40 legislators voting on various changes. Dodd, Frank and the other conferees addressed everything from regulating derivatives to limiting banks’ ability to bet their own money alongside their clients’. Conference committee culminated in a 20-hour marathon session in June. The combined bill then passed the House again — and today it cleared its last hurdle in the Senate, sending it to the president’s desk.

The final bill, more than 2,300 pages in length, directs regulators to create 533 rules, according to the Chamber of Commerce. The bill contains three central provisions. First, it provides the government with new powers to identify risky banking institutions and to shutter them before they harm the broader financial system, via a new systemic regulator. Henry Paulson, the Treasury Secretary under President Bush when the financial crisis first hit, lauded the provision this week. “We would have loved to have something like this for Lehman Brothers. There’s no doubt about it,” hetoldThe New York Times, referring to the investment bank that collapsed, destabilizing the country’s financial system and contributing to the credit crunch. Democrats say this provision ends “too big to fail,” by providing the government with a way of shutting down failing banks, reassuring counterparties and containing any sense of panic.

Second, the Dodd-Frank bill makes banksless dangerous, forcing them to keep more capital on hand, banning them from making risky trades on their own behalf and keeping them from investingheavily in vehicles like hedge funds.“[The bill] places some limits on the size of banks and the kinds of risks that banking institutions can take,” President Obama told an audienceof Wall Street workers this spring, speaking at Cooper Union in Manhattan. “This will not only safeguard our system against crises, this will also make our system stronger and more competitive by instilling confidence here at home and across the globe. Markets depend on that confidence. By enacting these reforms, we’ll help ensure that our financial system — and our economy — continues to be the envy of the world.”

Finally, it creates a new consumer financial protection bureau, which will have the power to create and enforce new rules regarding financial products like home-equity loans and credit cards. “Consumers finally will have a cop on the beat … that will monitor the market and write and enforce the rules,” said Susan Weinstock, the financial reform campaign director for the Consumer Federation of America. “The Wild West for financial products and services is coming to an end. Consumers will now have a bureau that will clear out the tricks and traps in financial products and services that have harmed so many Americans.”

That said, the bill is imperfect by anyone’s measure. It orders 68 studies, and leaves major decisions up to regulators prone to lobbying and industry influence. It includes loopholes, including the glaring exemptionof auto dealers who make car loans. But a broad range of experts on Wall Street, consumer protection and governance have lauded it as the strongest reform made since the Great Depression.

“This isn’t just about dollars and cents,” Sen. Harry Reid (D-Nev.), the majority leader, said on the floor. “It’s about fairness and justice. It’s about making sure there’s not a next time. It’s about jobs. And it’s about rescuing our economy.”

*Correction: *Sen. Scott Brown was initially incorrectly listed as being from Maine. Thanks to commenter Flitedocnm for pointing out that Maine cannot in fact have three sitting senators.

Hajra Shannon

Reviewer

Latest Articles

Popular Articles