A ‘Disastrous’ Republican Proposal to Redo Fannie and Freddie

It puts any housing recovery in jeopardy, says Barry Zigas of the Consumer Federation of America.

Jul 31, 202020.2K Shares493.6K Views

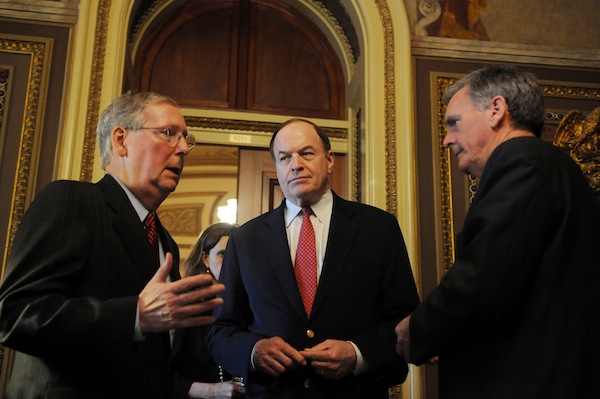

Sens. Mitch McConnell (R-Ky.), Richard Shelby (R-Ala.) and Judd Gregg (R-N.H.) (EPA/ZUMApress.com)

For the past year, Republicans have insisted that Congress take up legislation to stop the losses at Fannie Mae and Freddie Mac — the government-sponsored enterprises that buy up and repackage mortgages, keeping loan prices stable. Fannie and Freddie have incurred more than $150 billion in losses since the burst of the housing bubble. “In my view, it’s simply not acceptable for some on the other side to suggest that we have to rush this [Wall Street] bill through Congress, but that it’s okay to wait another year to address the GSEs, which we all know played a central role in the financial crisis,” Sen. Mitch McConnell (R-Ky.), the minority leader, arguedearlier this month, a contention often repeated.

[Economy1]But the Republicans never said how they thought the GSEs should be reformed — until now. Last Wednesday, Sen. John McCain (R-Ariz), Sen. Judd Gregg (R-N.H.) and Sen. Richard Shelby (R-Ala.) proposed an amendmentto Sen. Chris Dodd’s (D-Conn.) financial regulatory reform bill, the GSE (Government Sponsored Enterprise) Bailout Elimination and Taxpayer Protection Amendment.

Releasing the proposal — with numbers, dates and directives aplenty — Gregg commented, “Fannie Mae and Freddie Mac are synonymous with mismanagement and waste and have become the face of ‘too big to fail.’ The time has come to end Fannie Mae and Freddie Mac’s taxpayer-backed slush fund and require them to operate on a level playing field.”

But housing market experts describe the Republicans’ proposal as disastrous. Analysts from both sides of the aisle contend that the proposal would unwind Fannie and Freddie so quickly and precipitously that it would destabilize the entire housing market: pushing mortgage prices up, pulling support from low and middle-income Americans and ending the nascent — if at all extant — housing recovery.

The GSE amendment would effectively shutter the mortgage giants, which together backstopped 97 out of 100 new mortgages in the first three months of the year, according to Inside Mortgage Finance. It would keep keep the current government conservatorship in place for 24 months (or 30 months, if the Federal Housing Finance Agency determines that market conditions are “adverse”). Then, it would begin begin the process of dissolution.

Were Fannie and Freddie to prove “viable” as private institutions (a term left ambiguous) after 24 or 30 months, they would become highly regulated institutions for three years, before the expiry of their charters. They would have no affordable housing goals, would have to reduce their mortgage assets yearly, could not purchase mortgages exceeding median-home values and could only buy mortgages with certain minimum down payments — among other provisions. Additionally, they would have to pay taxes. Were Fannie and Freddie not “viable” in two years — likely, given that Fannie reported yesterdaythat it does not see itself reporting a profit for the “indefinite future” — the amendment puts them into receivership.

Housing experts say that the bill would impact every participant in the housing economy, including builders, buyers, developers, lenders and banks. It would make vanilla mortgages — such as 30-year, fixed-rate mortgages — much more scarce, and would make all mortgages more expensive. It would remove a major source of liquidity in the mortgage market, causing credit problems at mortgage-reliant banks. It would also rapidly reduce the number of homebuyers.

Experts describe the McCain-Gregg-Shelby amendment’s transition as too much, too soon and too blunt. Kenneth Posner, who analyzed Fannie and Freddie for Morgan Stanley and is the author of Stalking the Black Swan, describes the plan as going “cold turkey” when it might be better to “use methadone.”

“The issue is that what Fannie and Freddie issue is considered close to government debt, and there is no limit on their ability to grow. That was fine a long time ago when they were small. But now, they’re big — we’re creating trillions of dollars of Treasury-like debt,” he explains. “We’re also dealing with the reality that too much stimulus for the housing market is a bad thing. That’s what the Republican [proposal] is getting at. But it does not answer the question of the transition [away from that support].”

Barry Zigas, the director of housing policy for the Consumer Federation of America, is blunter. He says that the Republican approach takes a “meat-axe” to an extremely fragile market. “It takes a very prescriptive and dangerous approach to a problem that at this point does not require it,” he says, noting that the Senate has not even held hearings on how to deal with Fannie and Freddie yet.

“It puts any housing recovery in jeopardy — the amendment is a huge gamble that forces the government to quickly and radically restructure these two companies without providing a clear path to a stable mortgage market in the future,” he says. “For one, it would raise down-payment requirements precipitously, which would be injurious to low-income communities and communities of color.

“This is a very heavy-handed and ultimately very unhelpful approach to a complex problem.”

“Some of it is serious. Some is trying to stir up trouble,” says Dean Baker, the co-director of the Center for Economic and Policy Research. “It doesn’t make sense to talk about dismantling Fannie and Freddie yet — and we’d really have to think this through more thoroughly. It does not, for instance, explain how it would sell off Fannie and Freddie’s assets, or in what form. Who would back them? What is the benefit to rushing this?” Baker says. “The risk is so obvious that the proposal seems strange.”

And with such obvious risks and despite Republican pressure, Democrats have punted on the question of how to reform Fannie and Freddie. This spring, the Treasury Department released a set of seven questionsit said it was attempting to answer — stating that it was working on reform but needed more time. And yesterday, Sen. Mark Warner saidthe administration plans to release its Fannie and Freddie proposal next year.

“I think it’s a fair claim to make to say we haven’t done enough to address Fannie and Freddie,” Warner said. “It is the big elephant in the room that hasn’t been addressed.” But, “We’ll come back next year and take on Fannie and Freddie in a more thoughtful way.”

Paula M. Graham

Reviewer

Latest Articles

Popular Articles