Is It Really a Good Time to Buy a House?

Today, New York Times economics writer David Leonhardt has a good columnon why it might be a good time to buy a home in some unlikely parts of the United States.

Leonhardt shows that the rent ratio — the price of the home divided by the estimated annual cost to rent one like it — in many metro districts has fallen enough to signal that it is a good time to consider purchasing a home rather than renting one. Housing market experts believe that if the rent ratio is lower than 20, a home is of good enough value to consider buying. If the number is higher than 20, a purchaser is counting on real estate prices to rise to make up the higher aggregate cost of paying a mortgage. (During the worst of the housing bubble, homebuyers in places like Ft. Myers, Fla., were bidding on homes with sky-high rent ratios in the 40s.)

Leonhardt’s analysis shows that homes seem to be a decent deal in markets like California’s Inland Empire and Las Vegas — the very markets that stoked the worst of the housing crisis. But those parts of the country are suffering from high, high unemployment and a long real-estate hangover. And Leonhardt’s analysis does not take into account the fact that many mortgage experts believe those markets still have a ways to fall. I took the markets the Times column indicates might be a good deal — with rent ratios below 20 — and overlayed the data with information from RealtyTrac indicating the proportion of houses that received a foreclosure notice last month. In places like Washington, D.C., and Seattle, just one in 1,800 homes received a foreclosure notice. But in Las Vegas, one in 69 did, meaning a whole lot of houses might be coming on the market soon.

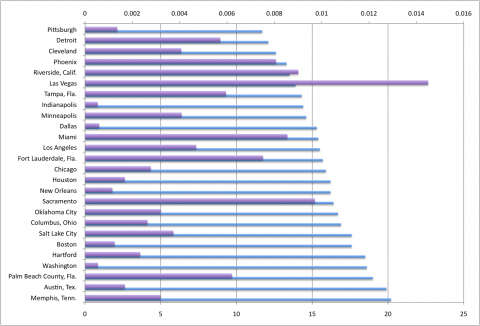

Indeed, the foreclosure crisis looks like it might worsenin many already hard-hit markets this summer and fall. The blue line on the graph below shows the rent ratio. The purple line shows the proportion of homes in the midst of foreclosure last month — and indicates markets that look likely to gain some capacity in the next few months.

So people looking to buy new homes might want to think twice before sinking their savings into one of the markets with a long purple line here, like Las Vegas or Riverside or Miami. On the other hand, the real estate markets in cities like Indianapolis, Dallas and Washington look considerably safer.